1分钟极速赛车官方开奖历史记录|一分钟查询结果记录、168开奖官网计划直播 Zany Takes on Holiday Wreaths Now on View in Central Park

Using everything from artificial hot dogs and candy wrappers to Metrocards, NYC Parks employees and commissioned artists reimagine a Christmas classic.

Battery Park City Authority Presents Pioneers of Public Art, New York in the 1980s and 1990s

This free event includes a panel with artists Mary Miss, Ned Smyth, and R.M. Fischer following the premiere of documentary shorts on their work. January 10, 2024, at 6:30pm.

The Unending Evolution of Nativity Scenes

From 3rd-century depictions to a Star Trek nativity, the art form never ceases to evolve.

Required Reading

This week, a virtual tour of the Vermeer retrospective, an AI-written novel wins a prize, filling your fish tank with local water, a tribute to poet Refaat Alareer, and more.

Institute of American Indian Arts Offers a Unique Low-Residency MFA in Studio Arts

MFASA students enjoy mentorships with prominent Indigenous artists, flexible schedules, and access to Santa Fe, New Mexico, a cultural capital of the US.

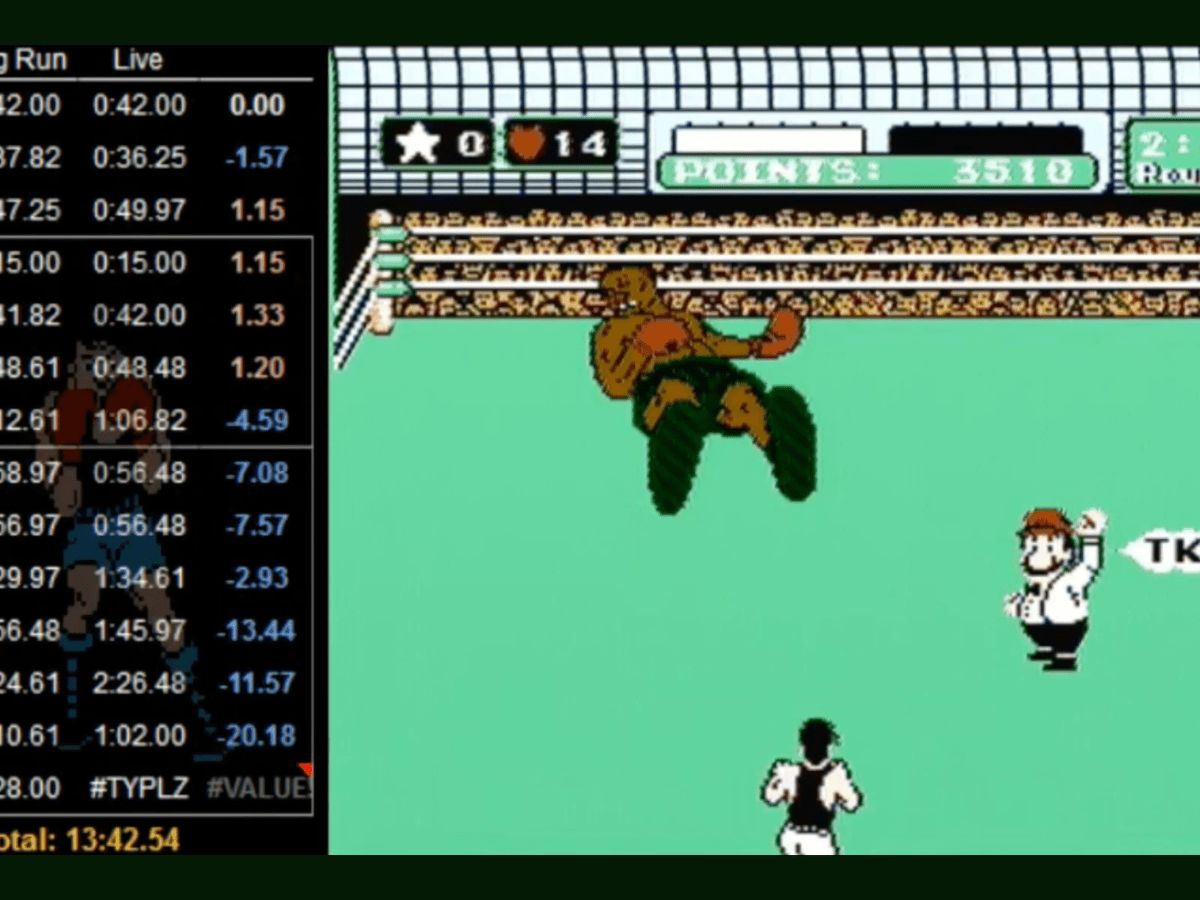

1分钟极速赛车官方开奖历史记录、168开奖官网计划直播、在线开奖直播现场 A Holiday’s Worth of Video Essays

This month, a range of video essays about tech-related subjects and history.

Coco Fusco’s Fight to Rebalance Power

Throughout her decades-long career, Fusco has laid bare the many mechanisms through which subjugated bodies are stripped of their agency.

Wormfarm Institute Releases Call for Artists for 2024 Farm/Art DTour

The organization will commission up to 10 artists to create large-scale temporary installations in farm fields in rural Wisconsin. Apply by February 12, 2024.